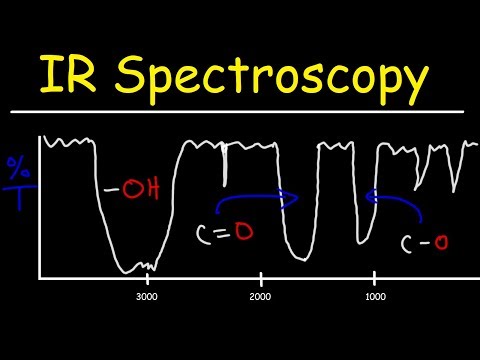

In this video, we're going to talk about IR spectroscopy, infrared spectroscopy. We're just going to go over the science behind it, some few details, talk about the shape, intensity, wave numbers, and factors that affect the frequencies that you see here. Then we're going to talk about what signals to look at, so that you can distinguish, let's say, an alcohol from a carylic acid, or an alkane from an alkene. And then, after that, we're just going to go through a series of multiple-choice practice problems, so you can know how to look at a graph and immediately tell what functional group it represents. So we'll do that towards the end of the video. So let's go ahead and get right into it. IR spectroscopy is very useful for determining functional groups. Let's say if you have a structure or a graph in front of you, you can tell if it's a carylic acid, an ether, or an ester. Now, when a molecule absorbs infrared radiation, which is just below red light under the visible spectrum, it causes molecular vibrations. The molecule can stretch, compress, or even bend when it absorbs IR radiation. Now, in this graph, on the y-axis, you have percent transmittance and the number increases from 0% all the way to 100%. Now, transmittance is the amount of light energy that passes through the sample. So if you look at this signal here, let's estimate that the percent transmittance is around 80%. That means that 20% of that energy was absorbed, and 80% passed through the sample. Now, if you look at this signal here, let's say it's at 10%. So, if 10% was transmitted through the sample, 90% was absorbed. So that's the relationship between absorbance and transmittance, inversely related. On the x-axis, you have what...

Award-winning PDF software

2016 IRS 940 Form: What You Should Know

Together with state unemployment tax systems, the FTA tax provides unemployment insurance tax at the federal level. Except the District of Columbia, all other states collect their own state unemployment tax. All states are required to collect their state unemployment tax under Title 26 of the United States Code, and the state Unemployment Tax Act. 2015 Form 940 — IRS Form 940for 2025 (Schedule A) — IRS Complete, sign, and submit this form with Form 940. 2 Form 843 for Income Tax This form is sent by the Social Security Administration to recipients of the Social Security Retirement Insurance Plan (SRS IP) payments (not benefits) who are not members of this plan. The form is for information only. It does not provide information or information as to the status of the recipient in terms of the individual's receipt of benefits or the amount of the benefits. The Social Security Administration will mail the form directly to the recipient's employer. To download the PDF file of this form, click here. 2015 Form 940 — IRS 2015 Form 940 for 2015: Employer's Annual Federal Unemployment (FTA) Tax Return. Department of the Treasury — Internal Revenue Service. 850222. OMB No. . 2016 Instructions for Form 940 — IRS This form is sent by the Social Security Administration to recipients of the Social Security Retirement Insurance Plan (SRS IP) payments (not benefits) who are not members of this plan. The form is for information only. It does not provide information or information as to the status of the recipient in terms of the individual's receipt of benefits or the amount of the benefits. The Social Security Administration will mail the form. To download the PDF file of this form, click here. Form 3115 (Form 3115-J) for Health Care Providers In order to request the Form 3115 (Form 3115-J), a health care provider must first identify the taxpayer of record as shown on any of the following: (1) An individual who has filed Form 940 (or a successor to Form 940), or (2) an individual who has an adjusted gross income (AGI) of at least 40,000.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 940, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 940 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 940 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 940 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 IRS 940